Parcus Group team can provide comprehensive merger and acquisition (M&A) consulting for our clients in the telecom and ICT industry including sell and buy side assistance.

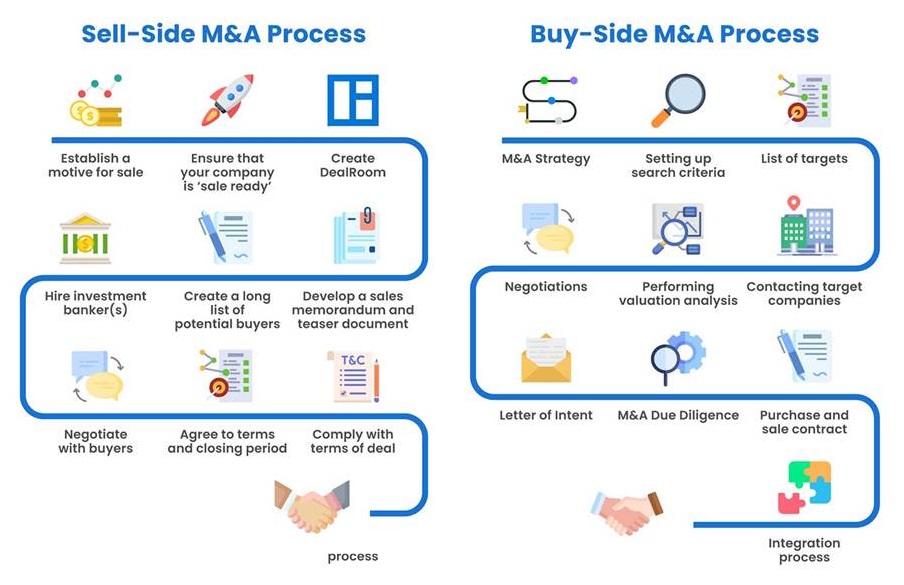

The M&A deal typically involves several steps. Here is a general outline of activities in each step:

| Sell-Side Steps | Buy-Side Steps |

| Planning and Strategy: The company, with the assistance of advisors such as Parcus Group, investment bankers or other M&A consultants, formulates a plan and strategy for the sale. This includes setting objectives, identifying potential buyers, and determining the desired deal structure. | M&A Strategy: The acquiring company develops its M&A strategy, which may include expansion into new markets, diversification, synergies, or strategic objectives. |

| Valuation: The company conducts a valuation analysis to determine the worth of the business. This involves assessing financial statements, market conditions, comparable transactions, and other relevant factors. | N/A |

| Preparation Information Memorandum: The company, often with the help of advisors, prepares an information memorandum or a confidential information memorandum (CIM) that provides an overview of the business, its operations, financials, market position, growth prospects, and other key details. These materials are designed to attract potential buyers. | N/A |

| Identifying and Approaching Potential Buyers: The company, along with its advisors, identifies potential buyers who may be interested in acquiring the business. They may use their networks, industry contacts, databases, or engage in targeted marketing efforts. Confidentiality agreements are signed with interested parties before sharing detailed information. | Target Identification: The company identifies potential target companies that align with its strategic goals. This can be done through internal research, industry analysis, networking, or utilizing the services of investment bankers or M&A advisors. |

| Due Diligence: Once potential buyers express interest and sign confidentiality agreements, they are provided access to additional information for due diligence purposes. This may include financial data, legal documents, customer contracts, intellectual property details, and any other relevant information needed for the buyers to assess the business. | Preliminary Assessment and Due Diligence: The acquiring company conducts a preliminary assessment of potential target companies to evaluate their strategic fit and feasibility. This may involve high-level financial analysis, reviewing public information, and assessing market dynamics. If a target passes the initial assessment, more detailed due diligence is conducted, which includes reviewing financial records, operations, contracts, legal matters, and other relevant information. |

| Negotiation and Deal Structuring: Interested buyers submit preliminary offers or indications of interest. The company and its advisors evaluate these offers and select a shortlist of potential buyers. Negotiations take place to refine the terms of the deal, including the purchase price, payment structure, conditions, and any contingencies. | Valuation and Offer Preparation: Based on the results of due diligence and valuation analysis, the acquiring company determines the appropriate valuation for the target company. Valuation methods may include discounted cash flow analysis, comparable company analysis, or other industry-specific approaches. The company then prepares an offer or indication of interest, outlining the proposed terms, including the purchase price, deal structure, financing arrangements, and any other relevant terms. |

| Letter of Intent (LOI) or Term Sheet: Once a buyer is selected and negotiations progress, a non-binding letter of intent (LOI) or term sheet is typically signed. This document outlines the key terms and conditions of the proposed deal, including the purchase price, deal structure, due diligence requirements, exclusivity period, and any other important details. | Negotiation and Letter of Intent (LOI): The acquiring company enters into negotiations with the target company to refine the terms of the deal. This includes discussing the purchase price, valuation methodology, deal structure, due diligence requirements, conditions, and any contingencies. Once the negotiations reach an agreement on the key terms, a non-binding letter of intent (LOI) or term sheet is typically signed. This document outlines the agreed-upon terms and serves as a roadmap for further due diligence and the drafting of definitive agreements. |

| Due Diligence and Documentation: The buyer conducts a detailed due diligence process to verify the information provided by the seller and assess any potential risks or issues. Simultaneously, legal and financial advisors on both sides work on drafting and negotiating the definitive agreements, such as the purchase agreement, disclosure schedules, and other relevant documents. | Due Diligence and Documentation: Following the signing of the LOI, the acquiring company conducts detailed due diligence on the target company. This involves a comprehensive examination of the target’s financial, operational, legal, and other relevant aspects. Simultaneously, legal and financial advisors work on drafting and negotiating the definitive agreements, such as the purchase agreement, disclosure schedules, and any other required documentation. |

| Closing: Once due diligence is completed, the parties work towards finalizing the transaction. This involves addressing any outstanding issues, obtaining necessary regulatory approvals, securing financing, and satisfying closing conditions outlined in the purchase agreement. The closing occurs when all necessary documents are signed, funds are transferred, and ownership of the business is officially transferred to the buyer. | Financing and Closing: The acquiring company secures the necessary financing to complete the acquisition. This may involve arranging debt financing, equity issuance, or a combination of both. The parties work towards satisfying any remaining closing conditions outlined in the purchase agreement. Once all conditions are met, the transaction is closed. This involves signing the final agreements, transferring funds, and officially assuming ownership of the target company. |

| Post-Closing Activities: After the transaction is completed, there may be post-closing activities such as integrating the acquired business, transitioning employees, notifying customers and suppliers, and managing any ongoing obligations or contingencies specified in the purchase agreement. | Post-Closing Integration: After the acquisition is completed, the acquiring company focuses on integrating the newly acquired business. This includes integrating operations, systems, and processes, harmonizing cultures, managing employees and talent retention, and leveraging synergies. Post-closing integration is crucial to achieving the anticipated benefits and value creation from the acquisition. |

It’s important to note that the M&A process can vary depending on the specific circumstances, the size and complexity of the deal, and the companies involved.

Engaging experienced advisors, such as Parcus Group as well as investment bankers and legal professionals, can help navigate the complexities and ensure a successful sale process.

Follow Us

Contact Us

Wehli Strasse 35-43/5/17, 1200 Vienna, Austria

Phone: +43 670 306 1260

Suite 2302, 23/F Lee Garden Two, 28 Yun Ping Road, Causeway Bay, Hong Kong SAR

Phone: +852 58080130

Suite 1306, 83 Queens Bridge St. Melbourne Southbank VIC 3006 Australia

Phone: +61 400 668 580

Email: contact@parcusgroup.com