Parcus credit analytics solution for telecoms is driven by 2 analytical models: one for businesses and one for individual customers. Models are built on individual customers historic application, accounts and bureau data.

The models assess new applications based on demographic, product and bureau characteristics and aggregate a credit score to rank them against the applicant profile. Based upon the credit score and a predetermined risk strategy, applications will be recommended for pre or post payment plans.

Parcus models construction leverage a mixture of quantitative and qualitative statistical techniques. Using logistic regression, an industry standard modelling technique, the analysis is aggregated into a ‘scorecard’, which will reward and penalise applications based on particular customer profiles, to arrive at an overall credit score.

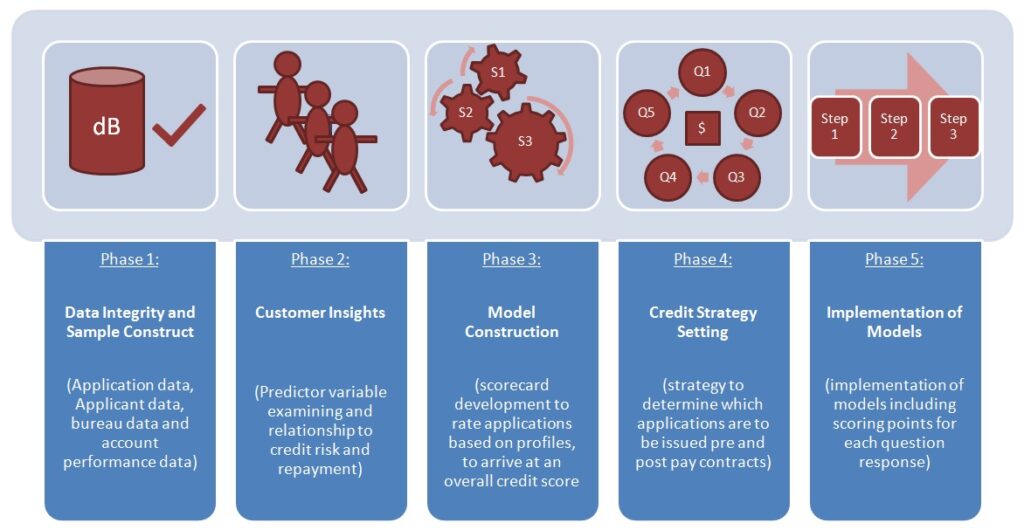

Our approach is below:

Phase 1 – Data Integrity and Sample Construction

As the solution is data driven, a significant integrity phase is necessary to ensure that the data for modelling is representative of customer’s applicant profiles. The following types of data are required to build the application models. The extent to which such data is available and its quality will determine the quality of the solution as well as the benefit to individual customer:

- Application data – information relating to the product and contract requested. If available; both accepted as well as rejected applications.

- Applicant data – information particular to the individual or business entity applying for the product.

- Bureau data – all credit report information relating to the applying individual or business.

- Account performance data – monthly performance data of accepted applications.

Two or more years of recent data is ideal for model construction, however the solution may be catered to smaller samples. Data will have to be delivered in an aggregated format either as an MS Excel spreadsheet or pipe delimited text file. Data integrity will conclude with the agreement on data development sample – agreed by customer and Parcus as a sample of data that represents applicant’s profiles and contains a range of predictor variables that can be used to assess the credit worthiness of an application.

Phase 2 – Customer Insight

Following data integrity and sample construction, customer insight analysis will be conducted. This entails taking each predictor variable and examining its relationship to credit risk and repayment. Customer will be engaged and the risk trend of each variable validated against business sensibility and signed off for use in Phase 3.

Phase 3 – Model Construction

Model construction will leverage a mixture of quantitative and qualitative statistical techniques. Using logistic regression, an industry standard modelling technique, the analysis from the previous stage will be aggregated into a ‘scorecard’, which will reward and penalise applications based on particular customer profiles, to arrive at an overall credit score. For example, the model may reward older applicants for their financial maturity and stability as opposed to younger applicants. The model will also be subjected to a variety of statistical tests validating its performance, stability and appropriateness to customer’s applicant profile. Once a preliminary model has been built, customer will be engaged to validate its appropriateness and composition. Customer’s commentary and feedback will be incorporated to arrive at Phase 3 model sign off.

Phases 4 and 5 – Strategy and Implementation

Parcus will work with our customers to determine an appropriate strategy to decide which applications are to be issued as pre and post pay contracts. This analysis will be based on customer’s risk appetite and business objectives.

Implementation of the models is possible typically in two ways.

- Standalone Excel spread sheet solution or

- Integrated Web based (with requirement for database platform for data storage and IT integration)

This option 1 is a faster and lower cost solution which will allow most customers to implement this solution into the credit checking business process with minimal intervention and impact on the business.

Option 2 requires development of full IT integrated solution based on the web-based data collection and database back end and can also be facilitated by Parcus Group.