Accurate telecommunications business and asset valuations are an important decision tool for boards and executive teams of any telecom company.

Parcus Group can provide expert and impartial valuations for telecom networks and assets including submarine cables, mobile companies, data centres, fibre networks, satellite providers or any other telecom industry asset or combination of assets.

At Parcus Group, telecom asset valuation models are developed by our in-house team of multi-disciplinary experts and are tailored to the requirements of each telecom operator or telecom regulator individually.

Our valuation framework and approach is built on a combination of industry best practises. To achieve the best and most realistic valuation outcomes we typically combine several valuation methods and their results into our modelling decision.

For example here are some of the valuation methods that are frequently used:

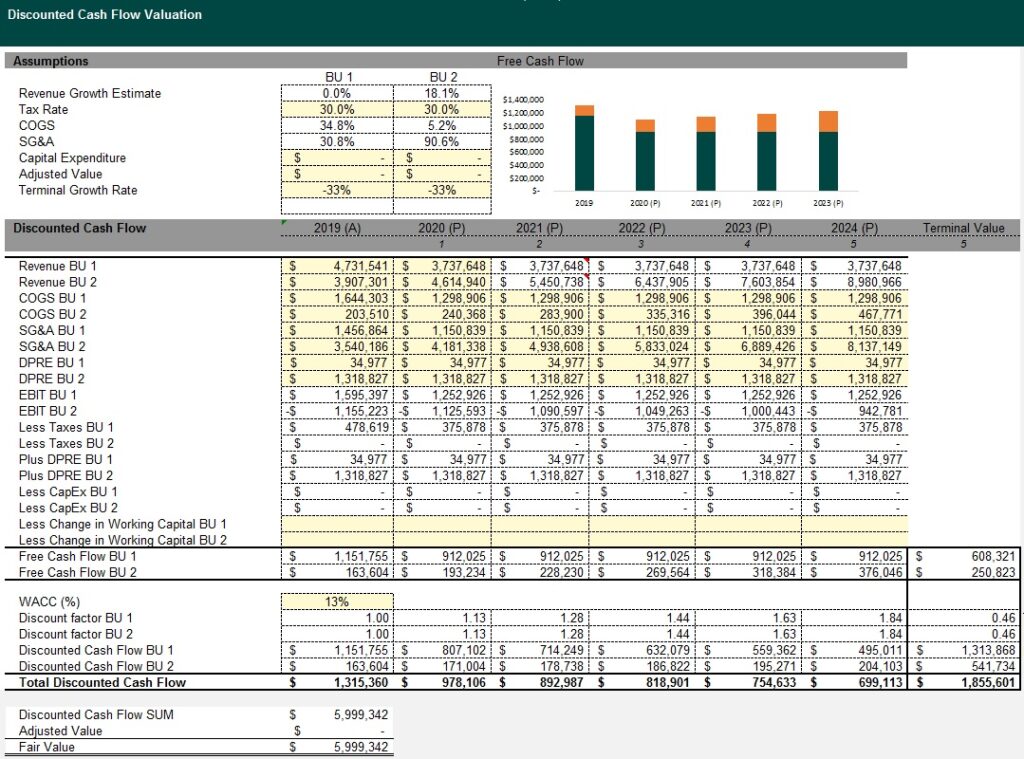

- Discounted Cash Flow (DCF) is a valuation method used to estimate the value of an asset or company based on its future cash flows. DCF analysis attempts to figure out the value of an investment today, based on projections of how much money it will generate in the future. Discounted cash flow (DCF) helps determine the value of an investment based on its future cash flows. The present value of expected future cash flows is arrived at by using a discount rate to calculate the discounted cash flow (DCF). Companies typically use the weighted average cost of capital (WACC) for the discount rate, as it takes into consideration the rate of return expected by shareholders. The DCF is one of the most commonly used models but has limitations, primarily that it relies on estimations on future cash flows, which could prove to be inaccurate

- Building Block Model (BBM) Valuation: output will be an asset value, expressed as RAB (regulated assed base) which will include the value estimate based on the expected WACC.

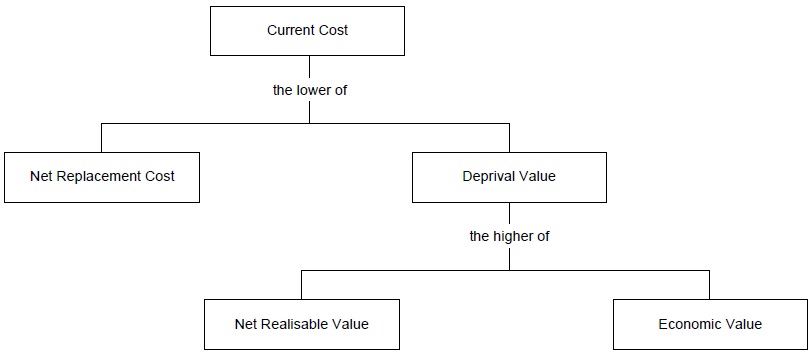

- Hybrid Valuation Methods can include multiple approaches as per the following diagram:

- The Net Replacement Cost is the cost of replacing the asset with another asset of similar characteristics and age.

- Deprival Value (DV) represents the recoverable value of the asset to the organisation, that is, the higher of the economic value the asset is likely to generate or the Net Realisable Value (NRV) of the asset if it were sold (this may be similar to the depreciation value of the assets remaining on the balance sheet).

- Economic Value (EV) is a measure of the value of an asset based on the net present value of future cash flows (so this would be identical to the DCF method).

For more information on how to develop telecom asset valuation models for your telecom organisation or if you require assistance please contact us.

Follow Us

Contact Us

Wehli Strasse 35-43/5/17, 1200 Vienna, Austria

Phone: +43 670 306 1260

Suite 2302, 23/F Lee Garden Two, 28 Yun Ping Road, Causeway Bay, Hong Kong SAR

Phone: +852 58080130

Suite 1306, 83 Queens Bridge St. Melbourne Southbank VIC 3006 Australia

Phone: +61 400 668 580

Email: contact@parcusgroup.com