Training Course Overview

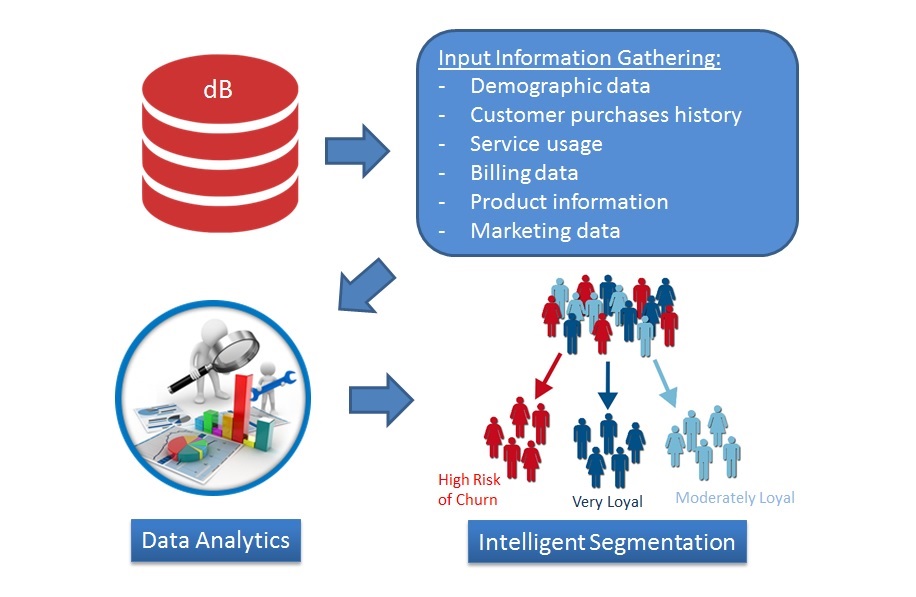

Our advanced data analytics training courses provide an in-depth insight into predictive modelling, churn analysis and credit risk models. Participants will acquire knowledge and skills required for planning, development, implementation and monitoring of analytical predictive models in the telecom industry.

| Key Training Topics Include: | |

| • Overview of Data Analytic and Predictive Modelling • Data Requirements for Model Building • Advanced Modelling Techniques • Risk Areas and Methodologies • Machine Learning Techniques • Model Implementation and Monitoring |

Analytics training is available in 3 distinct training courses:

– Telecom Data Analytics and Predictive Modelling Training: this is an advanced analytics course focused on practical data analytics and general predictive modelling.

– Telecom Churn Modelling Training Course: advanced course specifically designed and focused on predictive churn analysis and development of churn models.

– Telecom Credit Risk Modelling Training Course: course created for credit risk modelling with aim to increase the probability of payment result of post-paid customers.

Course Modules Breakdown (Example 2 Day Course)

| Module | Short Description |

| Day 1 | |

| Market Definition | Key questions to ask in order to define the problem and modelling requirements |

| Application Process | Define key business processes where modelling will intersect with other systems |

| Account Management | Marketing and financial implications of predictive modelling and impact on customers |

| Outcome/ Response Definition | Define required outcomes, criteria, time limitations, volumes of data. |

| Data Requirements for Model Building | Availability, complexity, requirements. History and applications data. Internal & external data. Customer demographics, product and billing data. |

| Introduction to Modelling Techniques | Overview of univariate analysis, correlation analysis, variable reduction techniques and statistical regression |

| Day 2 | |

| Advanced Modelling Techniques | Univariate Analysis – Catalogue of indicators, data quality (missing, invalid values, improbable values), predictive power, stability analysis Variable Reduction Techniques – Correlation analysis, co- linearity Regression – Clustering for market segmentation – Inference for declined profiles – Decision trees – Survival analysis techniques |

| Machine Learning Techniques | – Where it is used and description of key techniques – Explainability and interpretation difficulties, over-fitting concerns – Neural networks – Random forest – Genetic algorithms – Predictive text mining – Deep Learning – Ensemble Models |

| Strategy Design and Using Your Model | How to use your model, how to set cut offs, risk based pricing, rule setting, cross sell/up sell/ down sell |

| Model Monitoring | What to monitor – model characteristics, performance, stability, strategy adherence. |

Follow Us

Contact Us

Wehli Strasse 35-43/5/17, 1200 Vienna, Austria

Phone: +43 670 306 1260

Suite 2302, 23/F Lee Garden Two, 28 Yun Ping Road, Causeway Bay, Hong Kong SAR

Phone: +852 58080130

Suite 1306, 83 Queens Bridge St. Melbourne Southbank VIC 3006 Australia

Phone: +61 400 668 580

Email: contact@parcusgroup.com